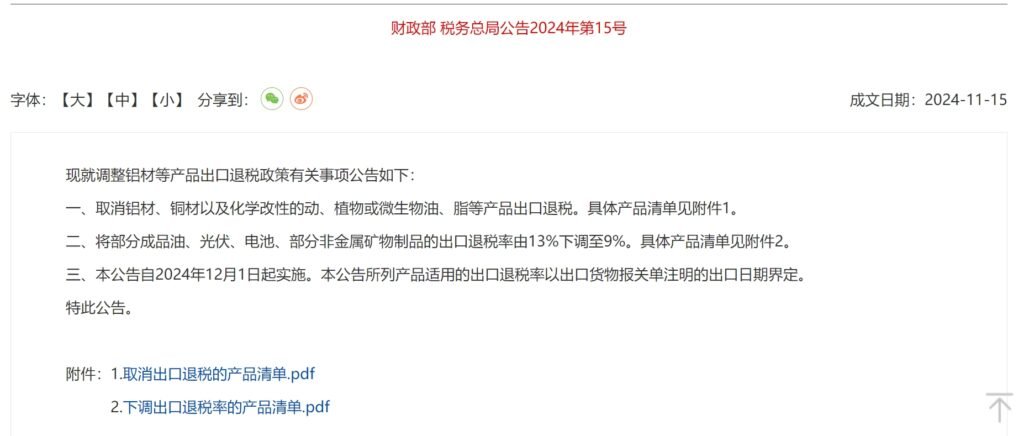

The Ministry of Finance and the State Administration of Taxation issued an announcement on adjusting export tax rebate policies on December 15th. The full text is as follows:

- Cancellation of Export Tax Rebates: Export tax rebates for aluminum products, copper products, and chemically modified animal, vegetable, or microbial oils and fats are canceled. A detailed product list is provided in Annex 1.

- Reduction of Export Tax Rebates: The export tax rebate rate for certain refined petroleum products, photovoltaic products, batteries, and some non-metallic mineral products will be reduced from 13% to 9%. Specific products are detailed in Annex 2.

- Implementation Date: This announcement will be implemented starting December 1, 2024. The applicable export tax rebate rate is determined by the export date recorded on the customs declaration form.

What Does This Mean for Photovoltaics (PV)?

Annex 2 indicates that the reduction in export tax rebate rates includes the following PV products:

- Wafers: “Monocrystalline silicon wafers (doped for use in the electronics industry) with a diameter >15.24cm” (HS Code 38180019).

- Cells: “Photovoltaic cells not mounted in modules or assembled into panels” (HS Code 85414200).

- Modules: “Photovoltaic cells mounted in modules or assembled into panels” (HS Code 85414300).

Impact on the Photovoltaic Industry

According to statistics from the General Administration of Customs, China exported PV materials worth $26.357 billion in the first three quarters of 2024:

- Wafers: $1.677 billion

- Cells: $1.921 billion

- Modules: $22.76 billion

With the previous export tax rebate rate of 13%, enterprises could receive $3.426 billion in rebates. After the adjustment, this figure drops to $2.372 billion—a decrease of $1.054 billion.

A Severe Blow to the Industry

The PV market is already plagued by intense competition, and many companies are operating at a loss. A sudden reduction of $1.054 billion in export tax rebates will undoubtedly have a significant impact.

To put it into perspective: the total net profit of 49 publicly listed PV companies in China in the first three quarters of 2024 was only 6.1 billion RMB. Using the Q3 average exchange rate of 7.1169 RMB/USD, the $1.054 billion reduction in rebates is equivalent to 7.5 billion RMB—exceeding the combined profits of these major PV firms.

While the export tax rebate rate has only been reduced by 4%, this minor adjustment could be catastrophic for many companies. In the first three quarters of 2024, the net profit margin of most PV enterprises did not even reach 13%.

A Move Toward Capacity Optimization

We believe this policy is a decisive step toward reducing overcapacity in the PV industry. In recent days, industry associations have convened several meetings with PV companies to discuss self-regulatory measures, such as limiting production and stabilizing prices. However, nothing is as direct or effective as lowering the export tax rebate rate to force the industry to consolidate.

For leading enterprises with a strong overseas market presence, pricing strategies for 2025 orders can incorporate these tax changes. However, not all companies possess the brand or market advantage to pass on these costs, meaning smaller players risk losing market share to industry leaders.

Moreover, with the new policy taking effect on December 1, 2024, most PV companies will need to fulfill current overseas orders under pre-agreed terms that do not account for this tax adjustment. As a result, Q4 financial reports, which were already challenging, will likely look even worse.

Why Not Cancel the Rebate Altogether?

Drastic changes are rarely implemented overnight. Canceling the rebate entirely could cause financial chaos for PV companies, as many would find their profit margins completely wiped out.

In markets like South America, some leading Chinese PV companies have been selling products at prices lower than domestic rates—even after accounting for shipping costs. This practice is largely supported by the 13% export tax rebate. Without it, such low-margin dumping would be unsustainable.

Essentially, these companies are leveraging state subsidies to compete in overseas markets. However, this approach has sparked criticism and even trade sanctions from the U.S. and Europe, where local PV manufacturers have struggled to compete against China’s low-cost products.

While the reduced export tax rebate will undoubtedly hurt exporters’ profits in the short term, this impact may be mitigated in the next sales cycle as companies adjust pricing strategies. A 4% price increase could address this tax reduction, and Chinese PV products would still remain highly competitive in global markets.

The policy could also incentivize Chinese PV companies to expand overseas manufacturing. Southeast Asia’s PV capacity may be less relevant, but newly built facilities in the Middle East may gain a significant cost advantage over domestic production.

Future Outlook

This reduction in export tax rebates may only be the beginning. Further reductions or a complete elimination of rebates are possible.

PV companies will be proactive:

- Strengthen overseas branding and channel development to support higher product pricing.

- Optimize cost structures and manufacturing efficiency to maintain profitability.

- Explore new overseas production bases to mitigate tax policy risks.

While this adjustment presents significant challenges, it also creates opportunities for industry leaders to consolidate their positions, innovate, and grow stronger in a competitive global market.